Sample CPA Exam Questions. The AICPA has released sample CPA exam questions. Here are 3 of the 50 Auditing sample CPA exam questions they have released. Please note that the AICPA does not release questions that they intend to use again, so studying these concepts may be of benefit to you, but the likelihood that this exact question is on the. Sample CPA Exam questions. These CPA Exam sample questions demonstrate some of the range in difficulty that these skill levels test. Different types of questions. The AICPA uses different types of questions to test its material. To ensure your success on the CPA Exam, you’ll need to have experience with each type of question prior to sitting. Feb 03, 2020 Sample cpa board exam questions philippines. Pwede po ba pumunta ang undergrad student dyan. It will help a lot. Sample cpa exam questions can improve your score past cpa exam questions and answers in the philippines cpa exam question and answers in the philippines. Naka compile po ba yan per board subject or per topic.

- Sample Cpa Exam Questions Philippines

- Practice Cpa Exam Questions

- Sample Cpa Exam Questions And Answers

- Audit Cpa Exam Sample Questions

- Sample Far Cpa Exam Questions

Looking to take the Uniform Certified Public Accountant Exam (CPA Exam) sometime in the near future? The CPA designation is one of the highest designations someone can earn in the field of accounting.

The CPA exam is very challenging and requires a ton of study time. There are 4 different tests that candidates must pass in order to earn their CPA designation.

Check out the guide below for everything you need to know about the CPA exam: who’s eligible, what's on the exam, and how to pass the exam itself.

CPA Exam Overview

CPA stands for Certified Public Accountant, and the Uniform CPA Examination is a test that all aspiring CPAs need to take. It tests various skills and overall accounting knowledge to determine whether a professional accountant is ready for certification. This test is required to practice public accounting, and it’s very long and intense compared to many other high-level tests required for lucrative positions.

The preparatory period for the CPA is comparatively long because there’s a lot of material to cover. Below, you can find some recommended study materials to better your score on the CPA. You can also check test-guide.com to find more study materials for a variety of tests.

CPA Exam Resources

| Resource | Notes | Provider |

| Official NASBA Candidate PDF | Official PDF from NASBA. Ton of information on the CPA exam. | NASBA |

| Free CPA Exam Questions | Try out these free CPA exam questions from Gleim. | Gleim |

| Free CPA Exam Questions | Sign up for a free trial and get access to free practice questions. | Surgent |

For more practice, check out our free CPA practice tests page.

CPA Prep Courses - If your career is riding on your success on the CPA exam and you have the budget, consider a CPA review course.

CPA Exam Content Outline

The CPA Exam is broken into four different sections. The test as a whole will require 16 hours to complete, with test-takers being allotted four hours per section. The four sections are:

- Auditing and Attestation (AUD)

- Financial Accounting and Reporting (FAR)

- Regulation (REG)

- Business Environment and Concepts (BEC)

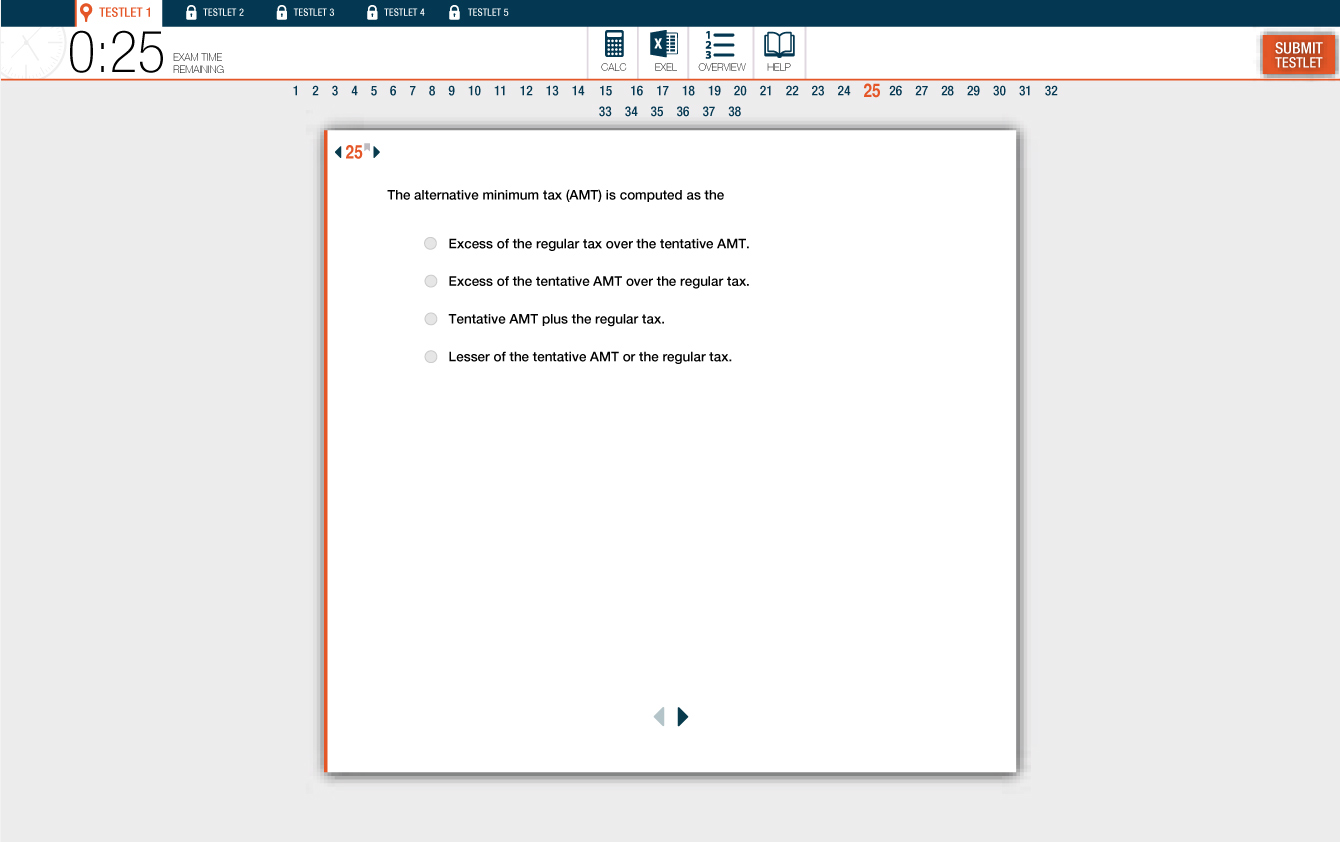

Each of the exam sections tests specific knowledge in those arenas with tailored questions. Every exam section is further broken down into five “testlets”, contain different operational or pre-test questions. Furthermore, each section’s content will vary between multiple-choice questions (MCQs) and task-based simulations (TBSs). Only one testlet requires written communication questions to be completed.

The AUD section has:

- 72 multiple-choice questions

- 8 task-based simulations

The BEC section has:

- 62 multiple-choice questions

- 4 task-based simulations

- 3 written communication questions

Sample Cpa Exam Questions Philippines

The FAR section has:

- 66 multiple-choice questions

- 8 task-based simulations

The REG section has:

- 76 multiple-choice questions

- 8 task-based simulations

Again, test-takers are given four hours for every test section. Multiple-choice questions are similar to those queries one can find on other tests. Task-based simulations are case studies that candidates respond to so they can prove their knowledge and skills. They need to generate unique and correct answers instead of selecting the correct answer from a preset collection.

The written communication tasks required test-takers to write letters, short passages, or memos that are relevant to the prompt.

All in all, the questions will challenge each applicant’s:

- remembering and understanding for between 10% and 40% of the test

- application of skills for between 30% and 60% of the test

- ability to analyze public accounting information or questions for between 15% and 35% of the test

- evaluation skills for accounting problems for between 5% and 15% of the test

The content covered over the CPA Exam’s four sections can vary based on current questions and focuses in the industry. But the test commonly derives questions from a few major fields:

- The AUD section provides questions that focus on professional responsibilities, ethics, assessing risk in developing plan responses, performing procedures and obtaining evidence, and forming conclusions and reporting accounting information

- The BEC section provides questions focusing on corporate governance, economic concepts and analysis, financial management, information technology, and operations management

- The FAR section is comprised of questions that emphasize conceptual framework and financial reporting, selecting financial statement accounts, selecting transactions, and state and local governments and how they apply to accounting work

- The REG section is made up of questions that focus on ethics, federal tax procedures, professional responsibilities, business law, federal taxation of property transactions, federal taxation of individuals, and federal taxation of entities

CPA Exam Administration

The American Institute of Certified Public Accountants (AICPA) is the organization responsible for developing the content of the examination, preparing the questions, and determining the method of scoring. They decide what’s on the test and who can take it.

The National Association of State Boards of Accountancy (NASBA) is also important, as they are a centralized resource to whom jurisdictions (states or counties) submit information on candidates. They’re also responsible for giving out examination data and advisory scores. Further, they promote uniformity across all testing locations.

The CPA Exam is proctored by Prometric, so testing windows are designated according to their schedule. This is the same organization that administers the GRE and GMAT tests for graduate students. They offer testing within eight months of the year, excluding the months of March, June, September, and December. In any other month, Prometric offers the test five or six days per week, with variation depending on where the test is administered.

CPA test-takers can:

- take one exam section at a time per day

- schedule one, some or all sections of the test during a single window or scattered throughout several testing windows

- schedule exam sections in whatever sequence they desire

- cannot take the same section more than once during a single test window

CPA Exams are offered in all 50 US states, as well as US territories like Puerto Rico, the Virgin Islands, and Guam. All students must pay a fee depending on their state of residence, in addition to extra costs for transcript reviews or online license verification. Aspiring CPAs should expect to spend about $1000 to complete all four sections of the exam.

CPA Exam Schedule - Continuous Testing

Beginning July 1, 2020, continuous testing will replace testing windows. Visit AICPA's Testing Window and Score Release Dates page for more information.

CPA Exam Requirements

Any aspiring accountant who wants to sit for the CPA Exam needs to have significant postsecondary education in the accounting field. A bachelor’s degree from an accredited institution used to be enough for most test administrators.

However, today’s advancements in accounting technology and new compliance laws mean that the AICPA has adjusted the educational mandate to require both 120 semester hours in a bachelor’s degree accounting program in addition to 30 hours of graduate-level education. These requirements are enforced in most US states. As a result, most aspiring accountants wanting to take this exam need a master's degree in the field or a related industry.

Acceptable degrees include master’s in:

- Accounting

- Taxation

- Finance

- An MBA with a concentration in accounting

Additionally, some states’ CPA requirements explicitly state a master’s degree is needed to sit for the CPA Exam. Others may also demand proof of citizenship or residency. If you want to sit for the CPA Exam, be sure to check out your state’s requirements ahead of time.

CPA Exam Scores

Every testlet has both operational and pretest questions; the latter are not scored, though they are indistinguishable from operational questions. Pretest questions are just used as “test” questions for future versions of the CPA Exam.

Every testlet with multiple-choice questions can be one of two difficulties – medium or difficult. Additionally, individual question difficulty can vary dramatically, although “difficult” tests are generally harder than those labeled “medium”. All CPA candidates receive medium testlets at first, though the succeeding section could be the same difficulty or higher. This is relevant because your CPA scoring process takes the difficulty of all questions into account.

All section scores are reported on a scale that goes from 0 to 99. Test-takers must reach total reported scores of 75 in order to pass that section. This is not a percentage – just a point total. Additionally, the total score from the FAR, REG, and AUD sections will be weighted as a combination of scaled scores from both the MCQs and TBSs. The BEC section is graded as a weighted combination of the scaled scores from all of their questions, including the written communication tasks.

The scaled scores described above are calculated using formulas that account for the difficulty of the questions.

Multiple-choice questions contribute:

- 50% of the score for all sections

Task-based simulations contribute:

Practice Cpa Exam Questions

- 50% of the score for the AUD, FAR, and REG sections

- 35% of the score for the BEC section

Written communication tasks contribute:

- 15% of the score for the BEC section

Furthermore, every section of the CPA Exam needs to be passed within an 18-month window. This window officially begins when the candidate passes the first exam. If the window goes by without all four sections being passed, the applicant must start again.

CPA FAQs

What are the four CPA exams?

Sample Cpa Exam Questions And Answers

Does it matter how many times you take the CPA exam?

What are the best CPA review courses?

What is CPA exam for?

How much are CPA prep courses?

Audit Cpa Exam Sample Questions

Sample Far Cpa Exam Questions

Last Updated: 1/13/2021